jersey city property tax rates

Under Search Criteria type in either property location owners name or block lot identifiers. The Average Effective Property Tax Rate in NJ is 274.

How Is Tax Liability Calculated Common Tax Questions Answered

They are saying they need more TAXPAYER MONEY TO SPEND.

. The countys average effective property tax rate is 346. Property Tax Revenue Per Capita. Sales Tax Revenue Per Capita.

To process click on Submit Search. 2022 Jersey Village Neighbors All rights reserved. The bad news is that the countys property tax rates are the highest in the state and one of the highest in the US.

So its primarily just budgeting first establishing a yearly expenditure level. The City of Jersey City Tax Assessor will appraise the taxable value of each property in his jurisdiction on a yearly basis based on the features of the property and the fair market value of comparable properties in the same neighbourhood. Left click on Records Search.

Under Tax Records Search select Hudson County and Jersey City. Under Search Criteria type in either property location owners name or block lot identifiers. Owners must also be given a prompt notice of levy escalations.

1 be equal and uniform 2 be based on current market worth 3 have a single estimated value and 4 be considered taxable in the absence of being specially exempted. New Jerseys median income is 88343 per year so the median yearly property tax paid by New Jersey. Tax amount varies by county.

The median property tax in New Jersey is 189 of a propertys assesed fair market value as property tax per year. Under Tax Records Search select Hudson County and Jersey City. General Tax Rate Average Tax Bill Average Residential Assessment.

If you have questions about how property taxes can affect your overall financial plans a financial advisor in Cherry Hillcan help you out. Taxation of real property must. Page 1 of 7273.

Camden County has the highest property tax rate in NJ with an effective property tax rate of 391. To process click on Submit Search. While Cape May County has the lowest property tax rate in NJ with an effective property tax rate of 128.

The tax rate for last year 2021 was 0742500 and they are setting the rate for 2022 at 0760150. 2015 74250 2016 74250 2017 74250 2018 74250 2019 74250 2020 723466 2021 74250 2022 760157. Jersey City as well as every other in-county public taxing unit can at this point calculate needed tax rates since market worth totals have been determined.

Within those confines the city sets tax rates. 20 on revenue from Jersey property Corporate income tax 0 standard rate 10 tax for regulated financial services companies 20 tax for Jersey utility and property income companies. Variable rate up to 20 for large corporate retailers Social Security contribution for employees.

Jersey Citys 148 property tax rate remains a bargain at least in the Garden State. JERSEY CITY TAX RATES AND RATIOS. Summits school tax rate is 094 and Summit sends 52 of their property tax dollars to the schools.

When summed up the property tax burden all owners bear is created. The average effective property tax rate in New Jersey is 240 which is significantly higher than the national average of 119. New Jersey has one of the highest average property tax rates in the country with only states levying higher property taxes.

Chatham Townships school tax rate is 111 and Chatham Township sends 65 of. Tax Rates Current 0723466 No New Revenue 0691336 Voter-Approval 0888379 De Minimis 0743566 Historical 07425. Left click on Records Search.

Jersey Citys 2021 school tax rate was 052 and Jersey City sent 37 of their property tax dollars to the schools. The remaining 63 of the property tax goes to the county and city.

Riverside County Ca Property Tax Calculator Smartasset

Summary Of The Real Estate Market Performance In Bergen County New Jersey List Of Towns Profile Description And In 2022 Bergen County Bergen County New Jersey Bergen

Property Taxes On Single Family Homes Rise Across U S In 2021 Attom

States With The Highest And Lowest Property Taxes Property Tax Tax States

Property Taxes By State Embrace Higher Property Taxes

New York Property Tax Calculator Smartasset

State Income Tax Rates Highest Lowest 2021 Changes

Local New York Property Taxes Ranked By Empire Center Empire Center For Public Policy

2022 Property Taxes By State Report Propertyshark

Property Taxes By State County Lowest Property Taxes In The Us Mapped

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

New York Property Tax Calculator 2020 Empire Center For Public Policy

State Corporate Income Tax Rates And Brackets Tax Foundation

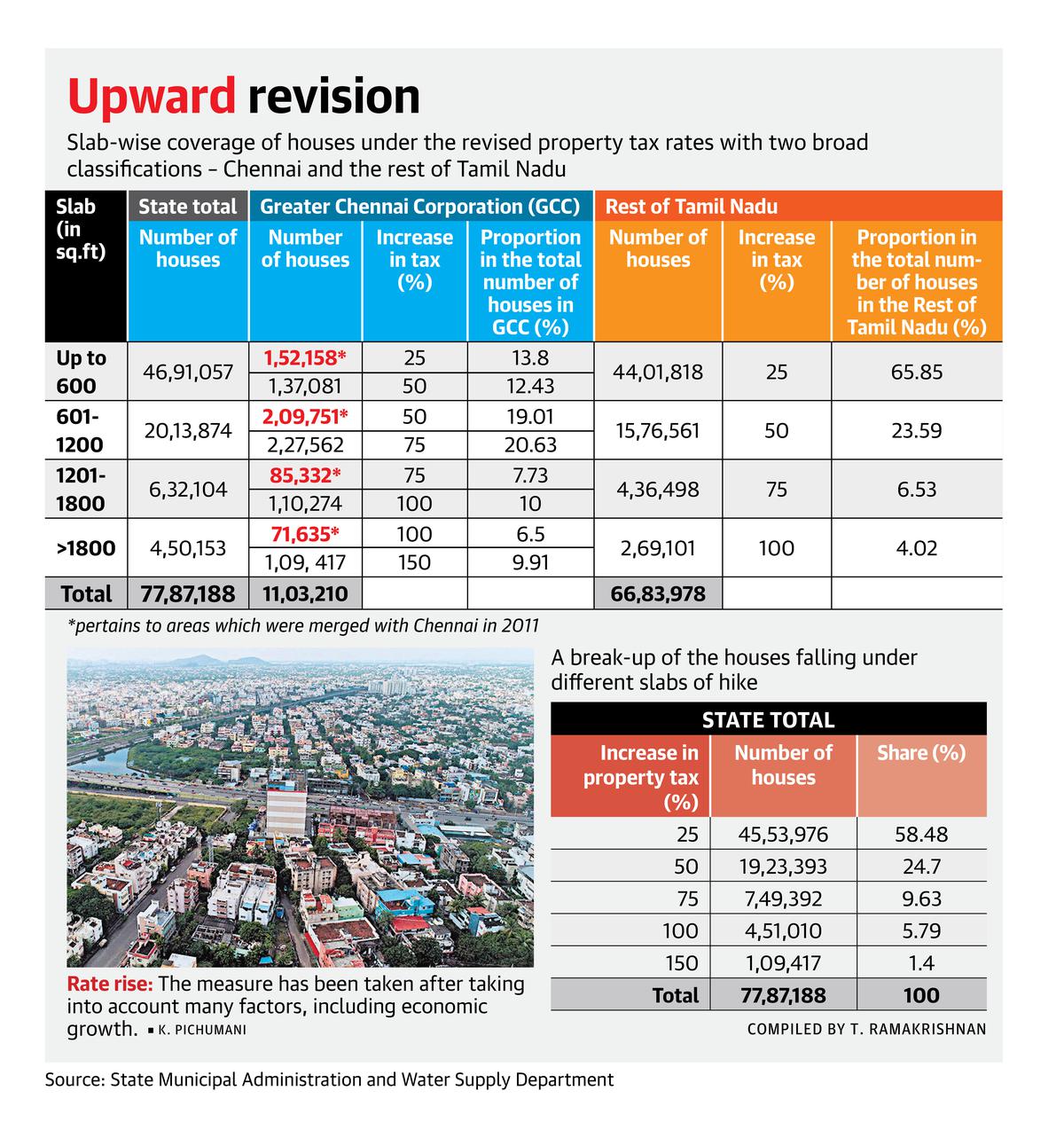

Tamil Nadu Property Tax Hike 25 50 Hike Covers About 83 Of Houses The Hindu

Monday Map State Local Property Tax Collections Per Capita Property Tax Teaching Government Map

Upstate Ny Has Some Of The Highest Property Tax Rates In The Nation

States With The Highest And Lowest Property Taxes Social Studies Worksheets Property Tax Fun Facts

Upstate Ny Has Some Of The Highest Property Tax Rates In The Nation

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation